Manipur Conflict Explained: Why Some Groups Question the Role of Assam Rifles

Published: 11 February 2026 | Updated: 11 February 2026

Introduction

The ongoing conflict in Manipur has created tension among different communities, including Meitei, Naga, and Kuki groups. During this period, Assam Rifles — one of India’s oldest paramilitary forces — has faced criticism from certain sections of society.

It is important to note that not all members of any community share the same opinion. However, concerns and mistrust have emerged in different areas due to the sensitive nature of the situation.

Here is a neutral and simplified explanation.

What Is the Role of Assam Rifles in Manipur?

Assam Rifles operates under the Ministry of Home Affairs and has key responsibilities such as:

-

Border security along the India–Myanmar border

-

Counter-insurgency operations

-

Assisting state police in maintaining law and order

-

Protecting civilians during conflict situations

Because Manipur shares an international border and has a history of insurgency, Assam Rifles has been deployed extensively in the region.

Why Some Meitei Groups Have Raised Concerns

During the recent conflict:

-

Certain Meitei civil organizations alleged that security responses were not balanced.

-

There were public demands for replacing Assam Rifles with other central forces.

-

Some groups expressed concerns over operational coordination between state police and central forces.

These concerns mainly stem from perceptions of uneven action during tense situations.

However, these views do not represent the entire Meitei population.

Why Some Kuki Groups Also Express Concerns

On the other side:

-

Some Kuki organizations have questioned security operations conducted in their areas.

-

There have been complaints about raids, detentions, and heavy security presence.

-

Civil society groups in some regions expressed fear and uncertainty during enforcement operations.

This shows that criticism has come from multiple sides, often for different reasons.

Historical Context: Naga and Security Force Relations

The relationship between security forces and some Naga groups has historical roots due to:

-

Decades of insurgency in Northeast India

-

Enforcement of AFSPA (Armed Forces Special Powers Act)

-

Past counter-insurgency operations

While peace talks and agreements have reduced tensions over time, historical experiences continue to influence perceptions in certain communities.

The Core Issue: Trust Deficit in Conflict Zones

In conflict situations:

-

Every community feels vulnerable.

-

Security actions can be viewed differently by different groups.

-

Rumors and misinformation can increase mistrust.

When tensions are high, even neutral actions may be interpreted as biased. This trust deficit is one of the main reasons behind criticism directed at security forces.

Important Clarification

-

Not all Meitei, Naga, or Kuki people oppose Assam Rifles.

-

Many civilians depend on security forces for safety.

-

Opinions vary widely within each community.

Avoiding generalization is important for maintaining social harmony.

Frequently Asked Questions (FAQs)

1. Does the entire Meitei community oppose Assam Rifles?

No. Opinions vary. Some organizations have expressed concerns, but many individuals do not share the same view.

2. Why is Assam Rifles deployed in Manipur?

Assam Rifles is deployed for border security, counter-insurgency, and maintaining internal stability, especially during conflict.

3. Have Kuki groups criticized Assam Rifles?

Some groups have expressed concerns regarding operations in their areas. However, opinions differ across regions.

4. Is this issue only about security forces?

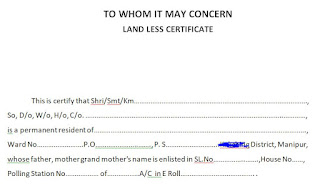

No. The Manipur conflict involves complex factors such as ethnic identity, land issues, political representation, and historical grievances.

5. Are peace efforts ongoing?

Yes. Government agencies, civil society groups, and community leaders are working toward dialogue and long-term peace solutions.

Conclusion

The criticism of Assam Rifles during the Manipur conflict arises mainly from mistrust, historical experiences, and the sensitivity of the situation. Different communities interpret events based on their perspectives and concerns.

A balanced understanding, responsible reporting, and open dialogue remain essential for restoring peace and trust in the region.

Disclaimer

This article is published for informational and educational purposes only. It does not support, promote, or oppose any community, organization, or security force. The content is based on publicly available information and general analysis of the situation. Readers are encouraged to verify updates through official government sources and trusted news platforms.

The author does not intend to spread misinformation, bias, or hatred against any group.